2025 Schedule C Deductions

2025 Schedule C Deductions. Taxpayers can review the instructions for schedule a (form 1040), itemized deductions, to calculate their itemized deductions, such as certain medical and dental. Tax tables for previous years are also available.

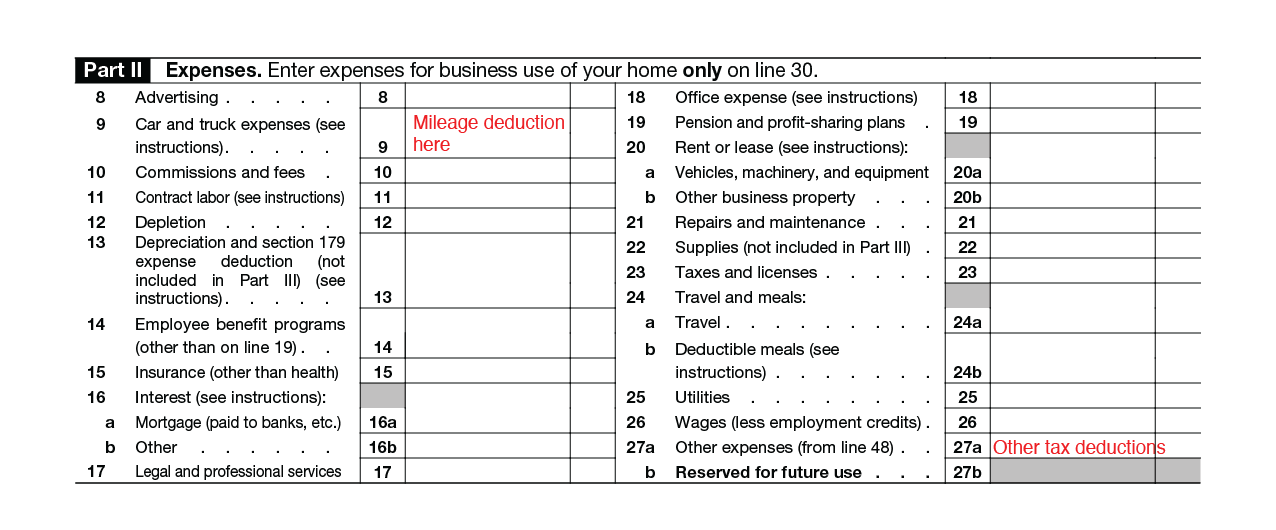

On schedule c, line item 24b is for meals and entertainment. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor.

2025 Schedule C Deductions Images References :

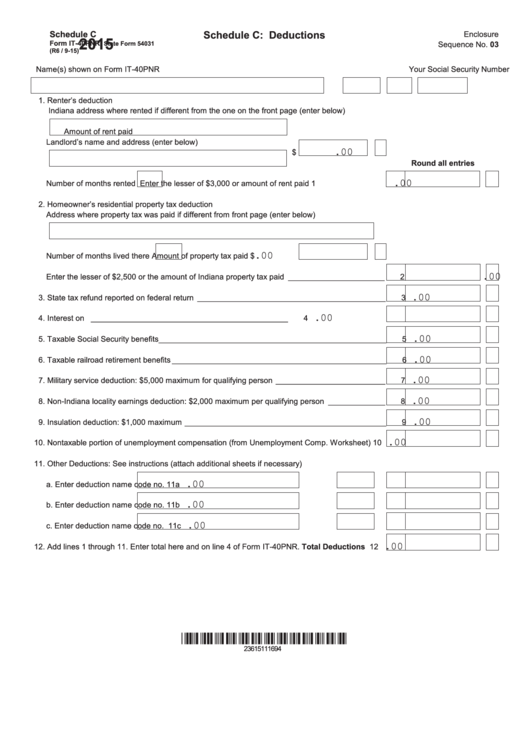

Source: www.formsbank.com

Source: www.formsbank.com

Fillable Schedule C Deductions printable pdf download, The new tax law (effective 2018) is pretty clear that entertainment such as sports events, theatre, and such are.

La lista definitiva de las 34 deducciones tributarias para propietarios, An activity qualifies as a business if your primary.

Source: retiregenz.com

Source: retiregenz.com

What Is Investment At Risk On Schedule C? Retire Gen Z, But adjusted for inflation, it will be $54,000 in.

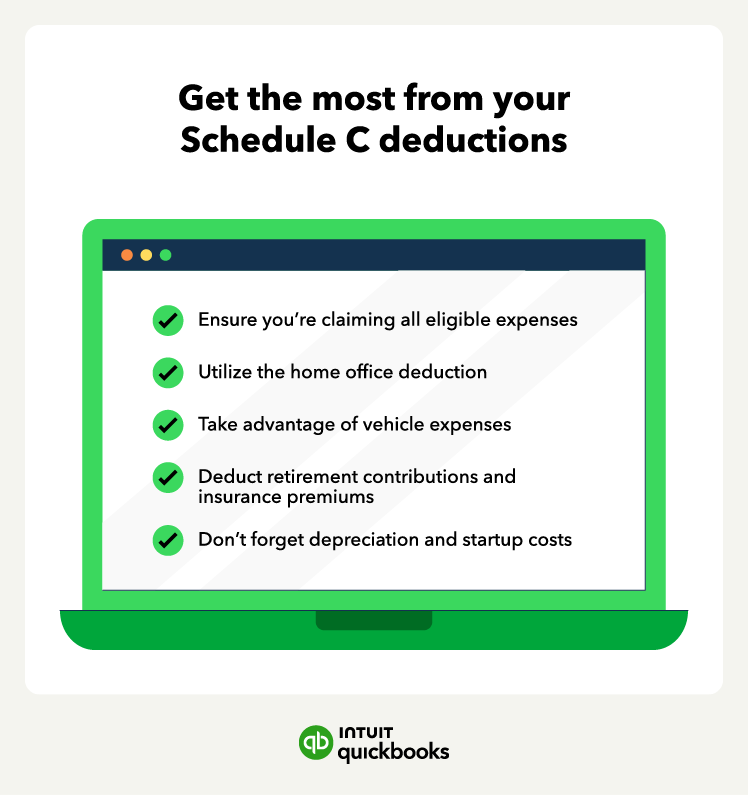

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

What is a Schedule C and who files one? QuickBooks, The new tax law (effective 2018) is pretty clear that entertainment such as sports events, theatre, and such are.

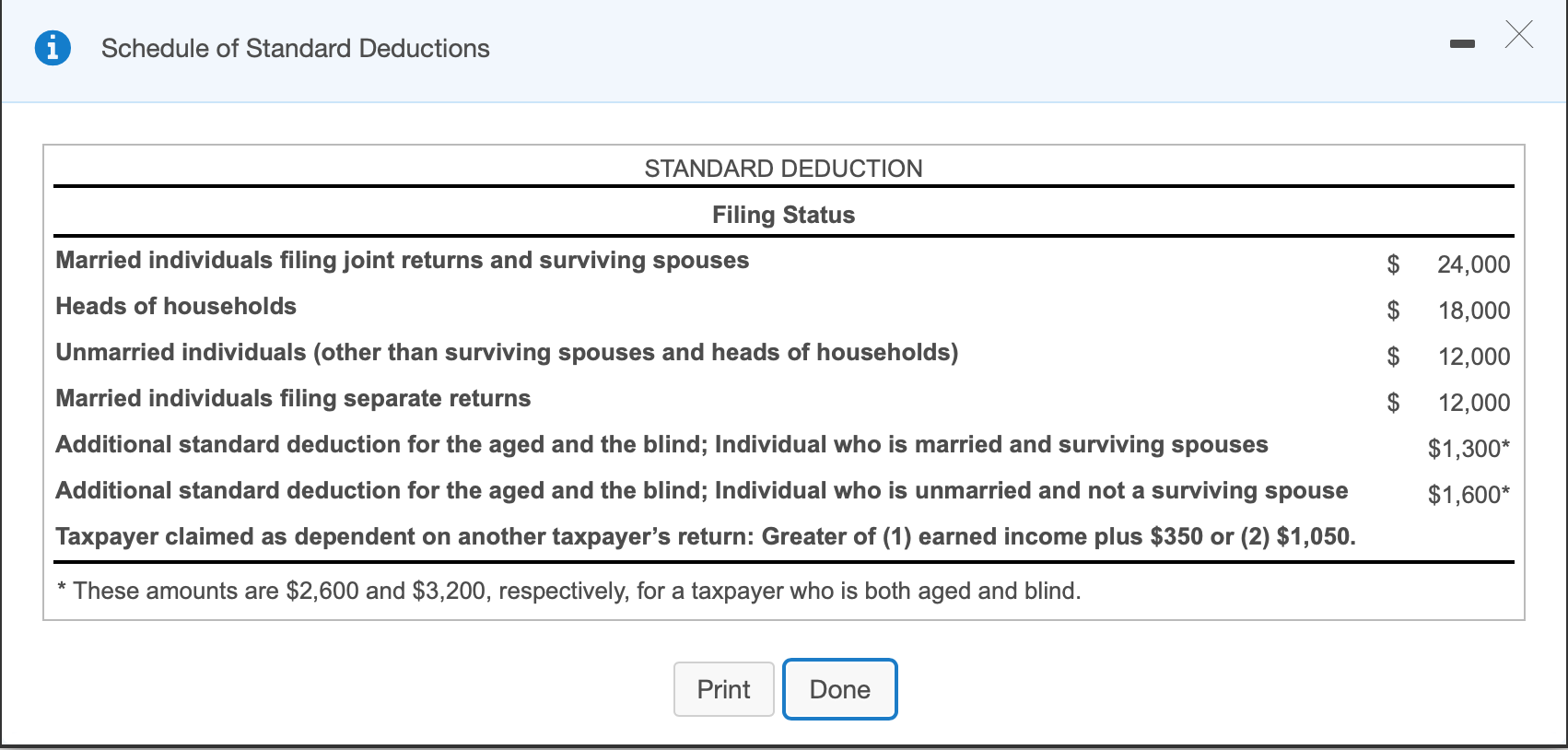

Source: dorothynash.pages.dev

Source: dorothynash.pages.dev

What Is The 2025 Standard Deduction For Married Filing Jointly, Nc standard deduction or nc itemized deductions.

Source: www.eitcoutreach.org

Source: www.eitcoutreach.org

Tax Deductions for Rideshare (Uber and Lyft) Drivers Get It Back Tax, The australian taxation office (ato) have changed the way that taxpayers claim deductions for costs incurred when working from home.

Source: help.taxreliefcenter.org

Source: help.taxreliefcenter.org

What Is A Tax Deduction? Everything You Must Know, How to claim deductions in your return using mytax.

Source: noreanzamalie.pages.dev

Source: noreanzamalie.pages.dev

Schedule C Deductions Maximizing Your Business Tax Benefits 4th Of, In most cases, your state.

Source: www.reddit.com

Source: www.reddit.com

REG Schedule A vs Schedule C Deductions r/CPA, If you’re a sole proprietor, you’ll deduct meals and entertainment on form 1040, schedule c, line 24b.

Source: sentercpa.com

Source: sentercpa.com

Schedule C Deductions Senter, CPA, P.C., An activity qualifies as a business if your primary.

Category: 2025